INTRODUCTION

Enterprise or Corporate Performance Management (EPM/CPM) emerged in the late 20th century to address limitations in traditional financial and operational planning systems. Early tools like spreadsheets and manual reporting were siloed and unable to scale with organizational complexity. In the 1990s, Corporate Performance Management (CPM) tools were introduced, focusing on financial reporting and planning. Over time, CPM evolved into EPM, incorporating operational planning, strategy alignment, and analytics.

Traditional EPM software often relied on spreadsheets and manual data entry, with limited real-time capabilities and periodic updates. This hindered timely decision-making and required multiple tools, leading to data inconsistencies. User interfaces were complex, demanding extensive training, and on-premise deployment required significant IT resources. These challenges highlighted the need for modern EPM solutions. Today’s systems offer unified platforms that integrate financial and operational data, providing scalability, agility, and seamless decision-making for dynamic business environments.

Key Components of EPM

EPM solutions typically include the following capabilities:

- Planning, Budgeting & Forecasting

- Close & Consolidation

- Account Reconciliations and Transaction Matching

- Compliance & Regulatory Reporting

- Predictive Modelling & Analytics

- AI Financial Forecasting

OneStream

OneStream is a comprehensive EPM solution that delivers end-to-end management for enterprise-wide consolidation, close, financial, and operational planning and forecasting within a unified platform. This eliminates the need for multiple solutions, interfaces, and integrations, reducing associated costs, data duplication, and time-consuming processes. By providing a single source of truth, OneStream enables finance and operations teams to collaborate effectively. This unified approach simplifies workflows and addresses upgrade challenges often faced with fragmented systems.

With a built-in data quality engine and pre-built connectors, OneStream ensures finance teams maintain control over data. It provides a strong and flexible foundation for managing data quality, enhancing accuracy and reliability.

OneStream is ERP and source system agnostic, offering real-time capabilities as needed. Its drill-down and drill-back functionality to any source ensures auditability across all close, planning, reporting, and analysis processes. This enables actionable insights behind every number, driving better decision-making.

Unified CPM Platform

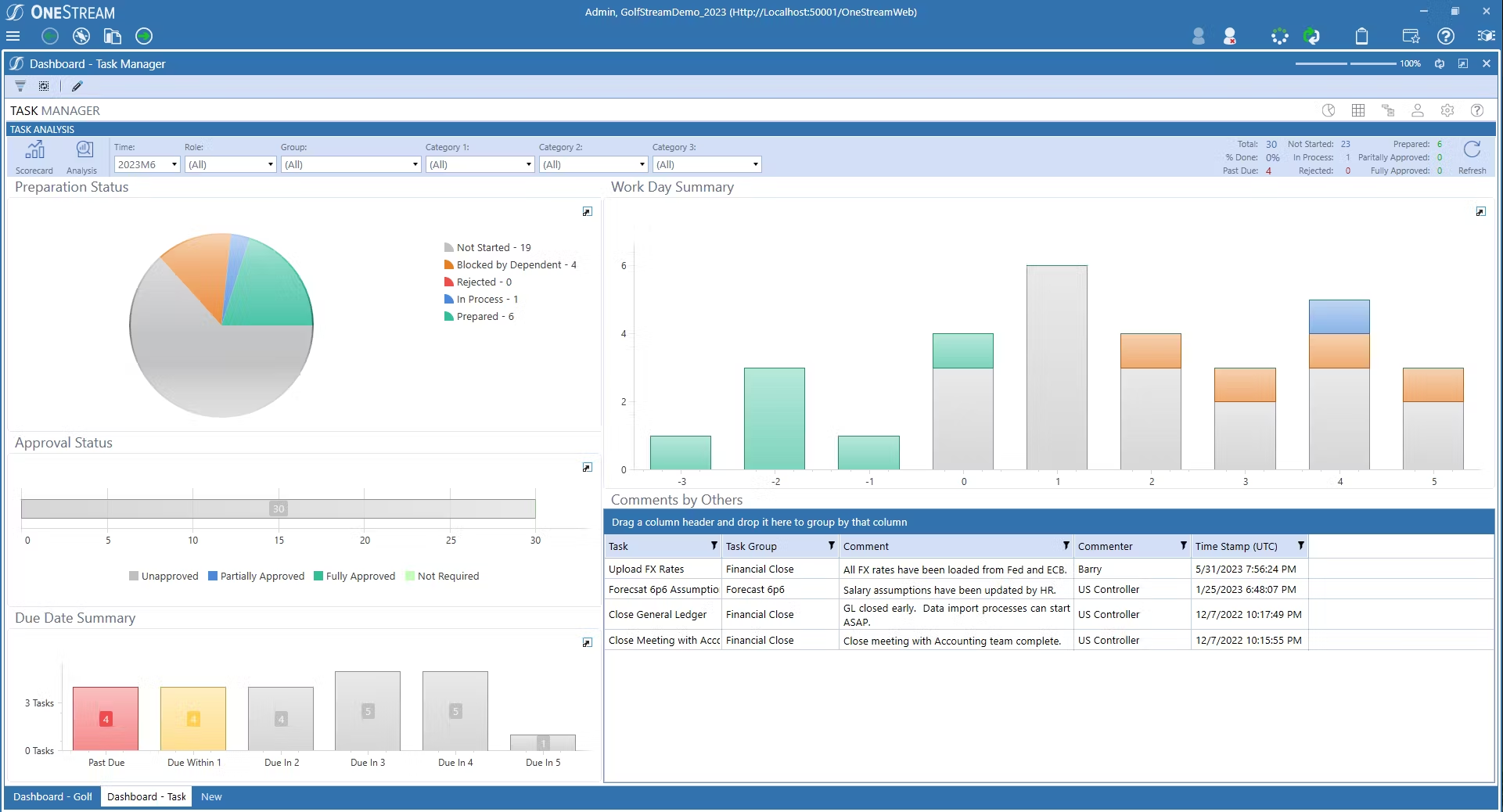

- A uniquely unified EPM solution, owned by finance, for end-to-end management of enterprise-wide consolidation, close, financial and operational planning & forecasting, reporting, and analysis.

- A built-in data quality engine that provides a strong, flexible foundation in integration and data quality, delivering confidence, trust, and a true single source of truth.

- Built-in self-service reporting, dashboarding, ad hoc analysis, and deep integration with Microsoft Office within one platform, allowing seamless drill-down and drill-back to supporting details for transparency, auditability, and actionable insights behind every number.

Despite its growing popularity and 100% customer success rate with over 1,400 customers, OneStream has a smaller but steadily expanding market presence compared to a few other alternatives.

Extensible Dimensionality

Extensibility is the core of OneStream's Intelligent Finance platform, enabling businesses to replace multiple legacy CPM systems with a single, unified solution. Hosted on Microsoft Azure, OneStream combines corporate standards with the flexibility for business units to report and plan at detailed levels without disrupting corporate controls.

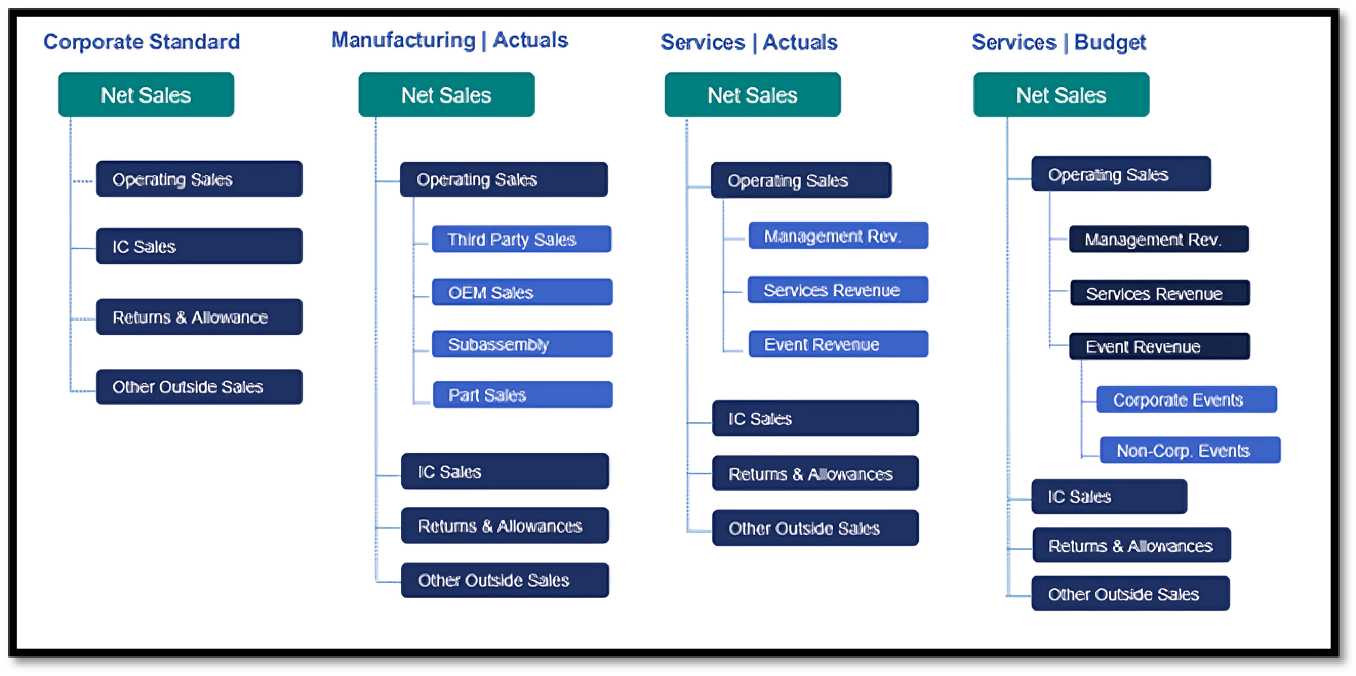

Let's look at an example using the chart of accounts dimension. In the example below,

Corporate has defined four accounts that roll into the Net Sales Account:

- Operating Sales, IC Sales, Returns and Allowances and Other Outside Sales

However, the Manufacturing division needs to track Operating Sales at a lower level of detail. Here's what they're tracking:

- Third-Party Sales, OEM Sales, Subassembly and Parts Sales

And the Services division tracks Operating Sales differently. They track the following:

- Management Revenue, Services Revenue and Event Revenue

In addition, for budgeting purposes, the Services division breaks down Event Revenue into Corporate Events and Non-Corporate Events.

OneStream enables businesses to manage detailed data at the division level while adhering to corporate standards. This allows for flexibility in managing data without compromising consistency or control.

With Extensible Dimensionality®, the same account, such as Operating Sales, can be used across different levels without the need to recreate reports, rules, or security settings. This eliminates reliance on offline spreadsheets, point solutions, or multiple CPM instances. The feature also simplifies data integration, validation, and reconciliation, reducing complexity. It provides a single, user-friendly platform designed to meet the demands of large, global enterprises.

OneStream Sensible ML

Sensible ML, OneStream’s first AI-enabled MarketPlace solution, is designed to productize time-series ML modeling for corporate performance management (CPM). It aims to break down the traditionally high barriers to entry for advanced analytics, making it accessible to organizations of all sizes. Instead of requiring businesses to build models and invest in the necessary infrastructure, Sensible ML delivers scalable data science capabilities.

Unlike most predictive analytics tools, Sensible ML goes beyond analyzing prior results. It incorporates additional business insights such as events, pricing, competitive information, and weather, enabling more precise and robust forecasting.

Aligning Operational Plans with Financial Goals

Spreadsheets are commonly used for planning, but purpose-built software offers better process control and reduces errors. Many budgeting and forecasting solutions fail to align financial results with operational plans, leaving users reconciling data instead of analyzing the business.

OneStream’s Intelligent Finance Platform helps eliminate disconnected spreadsheets, point solutions, and legacy systems by streamlining planning, improving visibility, and increasing alignment between finance and operations, significantly reducing total cost of ownership. Key capabilities include:

- Extensibility: Allows teams like Sales, Product Management, Marketing, and Operations to plan at a granular level while adhering to corporate reporting standards.

- Financial and Operational Alignment: Real-time integration between operational plans and financial statements on a unified platform.

- Business Insights Across Source Systems: Provides transparency and drill-through to ERP, CRM, and HCM systems for deeper insights and variance analysis.

- Purpose-Built Applications: Specialized applications for Sales, Operations, and HR capture detailed planning data at the opportunity, project, and human capital levels.

- Built-in Analytics & Dashboards: Interactive visualizations and analytics deliver management insights quickly, with transparency into source transactions.

OneStream enables a unified approach, driving better business alignment and reducing costs across the board.

Conclusion

OneStream streamlines financial processes and replaces legacy systems, offering efficiency, accuracy, and agility for businesses. It unifies operations and enhances extensibility, making it a powerful tool for Enterprise Performance Management. Learn more at OneStream's official website.

Looking forward, OneStream will continue to drive innovation and support global enterprises, empowering organizations to stay agile and transform finance operations in a rapidly evolving market.