In the fast-paced world of business, efficient financial planning is crucial to success. Whether you're a startup or a global enterprise, the ability to forecast accurately, allocate resources wisely, and adapt to market changes can determine how well your business thrives. This is where Oracle Hyperion Planning comes in—a powerful tool that helps businesses streamline financial planning, budgeting, and forecasting with greater precision and efficiency.

The Challenges in Financial Planning: Why Businesses Struggle with Budgeting and Forecasting

Many organizations face obstacles when managing their financial planning and budgeting processes. These issues often stem from fragmented systems and lack of integration, leading to inefficiencies and data inconsistencies. Common challenges include:

- Data Inconsistency: Different departments use separate systems or spreadsheets, resulting in discrepancies that affect financial planning and reporting.

- Manual Workload: Many financial tasks, such as spreadsheet updates, data entry, consolidation, and report generation, are handled manually, leading to errors and inefficiencies.

- Limited Collaboration: Without a centralized platform, teams often struggle to collaborate effectively, causing delays and miscommunication.

- Difficulty in Scenario Planning: Accurate financial forecasting is challenging without the ability to simulate different “what-if” scenarios and analyze their impact.

These challenges make it difficult for businesses to achieve accurate, timely, and actionable financial insights.

How Oracle Hyperion Planning Solves Financial Planning Challenges

Oracle Hyperion Planning is designed to address these common challenges and improve your financial management processes. Here's how it helps:

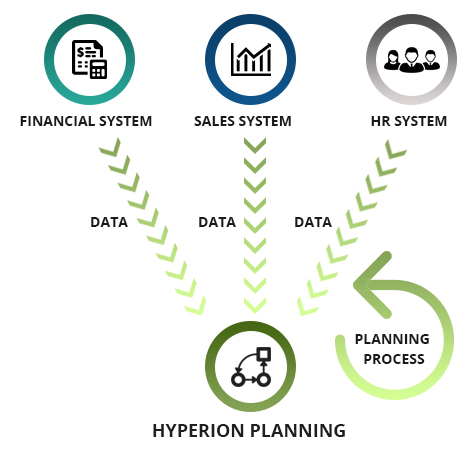

1. Centralized Platform for Financial Data

Oracle Hyperion Planning centralizes data from all departments and financial systems, ensuring consistency and alignment across your organization. It integrates budgeting, forecasting, and financial reporting into one cohesive system, making it easier to maintain accurate financial records and streamline processes.

2. Automation of Manual Processes

With Oracle Hyperion Planning, tasks like data consolidation, calculations, and report generation are automated. This reduces human error and accelerates the entire financial planning cycle, enabling your team to focus on strategy and analysis rather than manual work.

3. Real-Time Collaboration

The platform supports multiple users working simultaneously on the same plan or budget. Teams can collaborate in real time, share insights, and make immediate adjustments as necessary. This enhances communication and ensures that everyone is aligned with the financial goals of the organization.

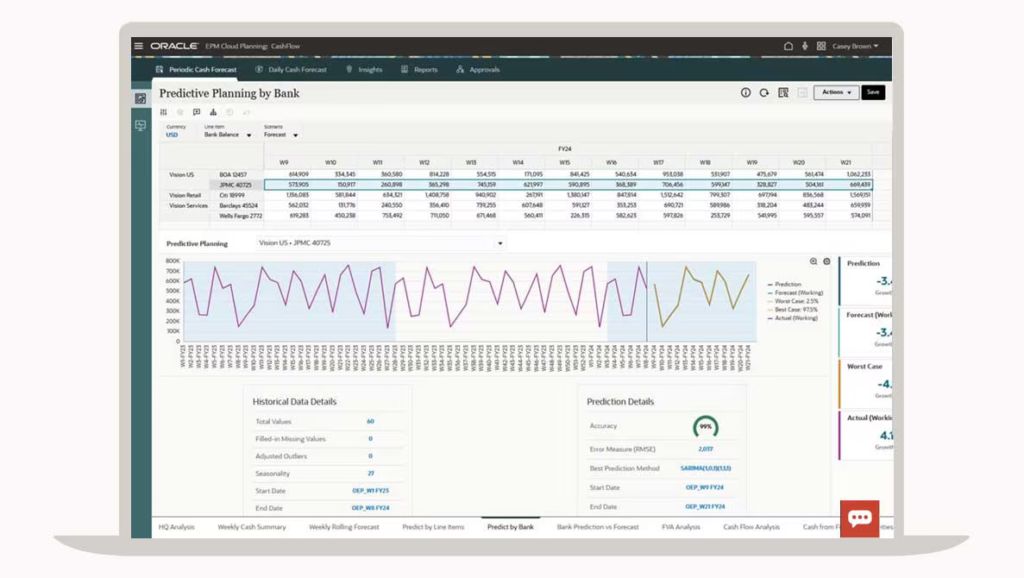

4. Advanced Scenario Planning and Forecasting

One of the standout features of Oracle Hyperion Planning is its scenario planning capabilities. The tool allows you to create multiple financial scenarios, assess their potential impact, and make informed decisions based on different market conditions. This flexibility prepares your business for both best-case and worst-case scenarios.

Real-World Examples and Use Cases: How Companies Are Benefiting

Several leading companies across different industries have successfully implemented Oracle Hyperion Planning to streamline their financial planning and forecasting processes. Here are a few examples:

| Company | Problem | Solution (Oracle Hyperion Planning) | Impact |

| Coca-Cola | Fragmented financial systems across regions, leading to inconsistent data and reporting. | Centralized financial planning and budgeting on a single platform. Automated data integration across regions. | Streamlined budgeting, improved visibility, faster decision-making, and better alignment across global teams. |

| Sony | Manual forecasting processes prone to errors, difficulty in forecasting costs in hardware division. | Automated budgeting and forecasting with scenario planning. Enhanced cost forecasting and budgeting accuracy. | Reduced errors in forecasting, better cost control, and improved ability to assess risks and opportunities. |

| Johnson & Johnson | Time-consuming, complex manual budgeting and planning across global operations. | Integrated budgeting and forecasting with real-time data, reducing manual effort and improving data accuracy. | Reduced budgeting time by 50%, improved financial transparency, and faster responses to market changes. |

| Dell Technologies | Difficulty managing complex financial models across product lines and global regions. | Unified budgeting and forecasting platform with advanced financial modeling and scenario analysis capabilities. | Improved accuracy, efficiency, and global financial performance visibility. More informed decisions on resource allocation. |

Conclusion: Why Oracle Hyperion Planning is Essential for Modern Businesses

Oracle Hyperion Planning is a game-changer for financial management. By addressing the challenges of fragmented systems, data inconsistency, and limited collaboration, it replaces them with streamlined workflows, real-time collaboration, and data-driven insights.

By adopting this powerful platform, organizations can:

- Achieve more accurate forecasting and better resource allocation.

- Quickly respond to market changes and financial challenges.

- Enable more data-driven decision-making for greater business agility.

For businesses looking to stay ahead in a competitive landscape, Oracle Hyperion Planning is a must-have solution. To learn more, Check out our blogs on Hyperion!